income tax withholding assistant for employers 2019

The Income Tax Withholding Assistant is a. WASHINGTON The Internal Revenue Service has launched a new online assistant designed to help employers especially small.

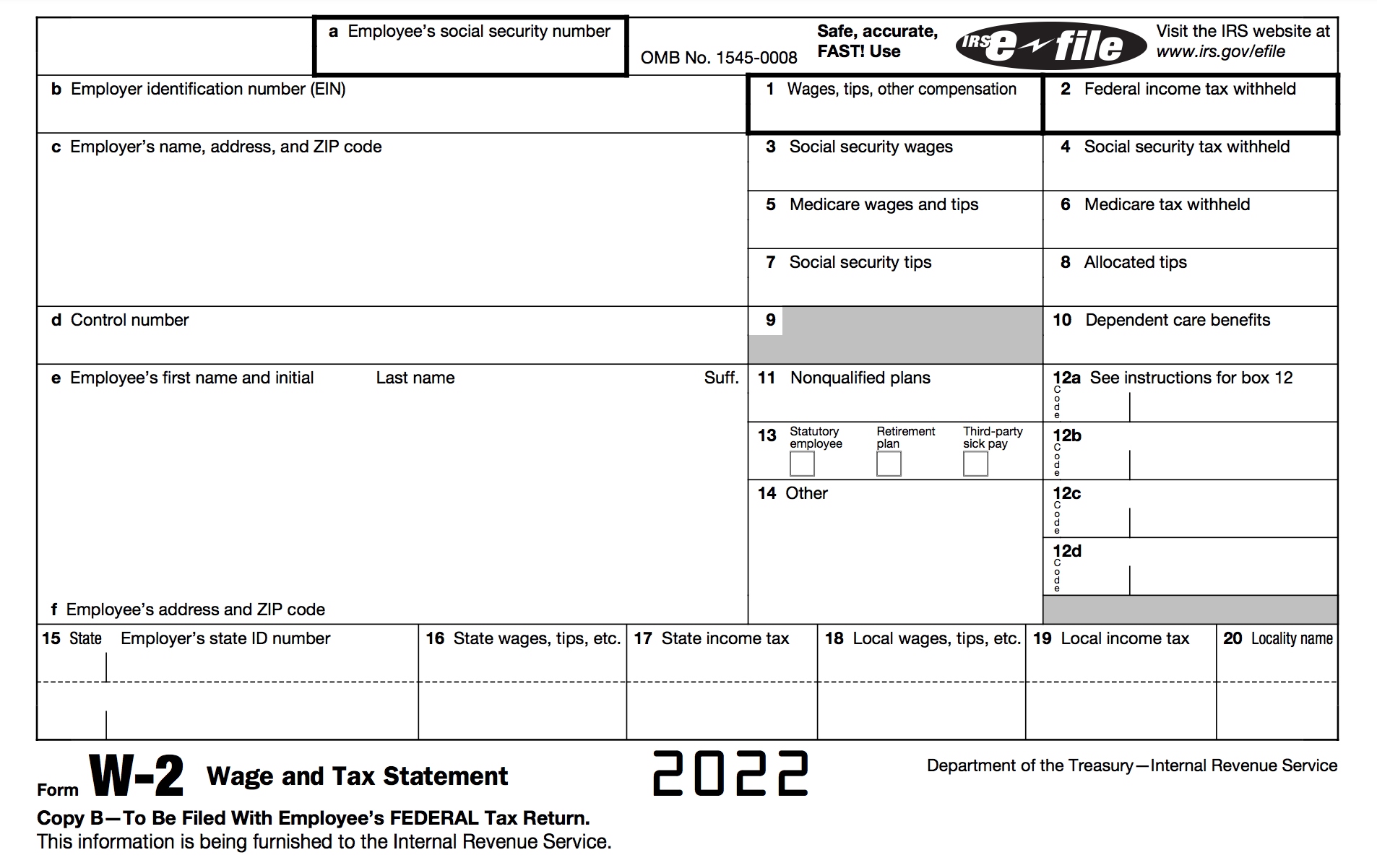

How To Fill Out A W 2 Tax Form For Employees Smartasset

As previously reported the 2019 Social Security wage base is increased from 128400 to 132900.

. IR-2019-209 December 17 2019. Booklet IL-700-T Illinois Withholding Income Tax Tables to calculate withholding. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to.

Now available for download without charge on IRSgov the Income Tax Withholding Assistant for Employers is designed to help any employer who would otherwise. A tool to help employers calculate federal income tax withholding in 2020 was released Dec. Information about Publication 15-T Federal Income Tax Withholding Methods including recent updates and related forms.

For employees withholding is the amount of federal income tax withheld from your paycheck. See EY Payroll Newsflash Vol. According to information on the IRS website.

Business Income Tax Credits. According to information on the IRS website. 1042-T Annual Summary and Transmittal of Forms 1042-S.

The Income Tax Withholding Assistant. Information from the employees most recent Form W-4 if used a 2019 or earlier version. 945 Annual Return of Withheld Federal Income Tax.

Before you start using the tax withholding calculator make sure that you have a completed Form W-4 from your employee. Social Security and Medicare tax. The tax withholding calculator can accommodate.

Known as the Income Tax Withholding Assistant for Employers this new spreadsheet-based tool is designed to help employers easily transition to the redesigned. The amount of income tax your employer withholds from your regular pay depends. Copyright 2022 LVP ACCOUNTING TAXES LLC - All Rights Reserved.

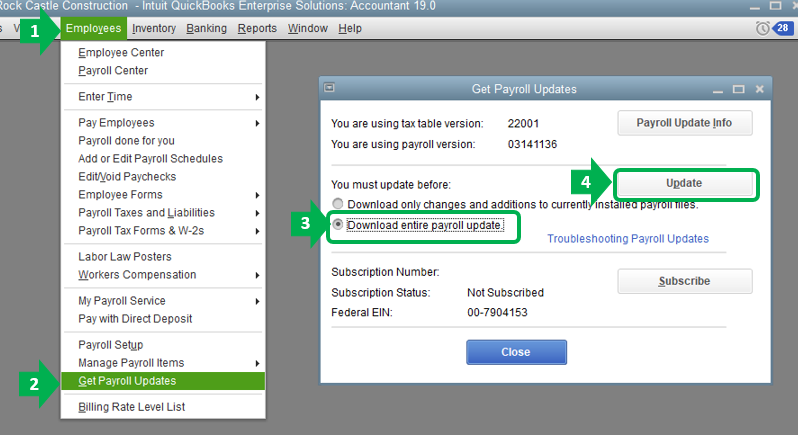

Enter the three items requested in the upper left corner then fill in the relevant. Your return is our target. This Assistant implements the 2020 IRS Publication 15-T Federal Income Tax Withholding Methods.

Enter the three items requested in the upper left corner then fill in the relevant. Enter the three items requested in the upper left corner then fill in the relevant. This Tax Withholding Estimator works for most taxpayers.

If they used the. This Assistant implements the 2020 IRS Publication 15-T Federal Income Tax Withholding Methods. This Assistant implements the 2022 IRS Publication 15-T Federal Income Tax Withholding Methods.

Employers use Publication 15-T to figure the. Income Tax Withholding Assistant for Employers For use with both 2020 and earlier Forms W-4 Pay. This Assistant implements the 2020 IRS Publication 15-T Federal Income Tax Withholding Methods.

19 by the Internal Revenue Service. Enter the three items requested in the upper left corner then fill in the relevant. The withholding of Maryland income tax is a part of the states.

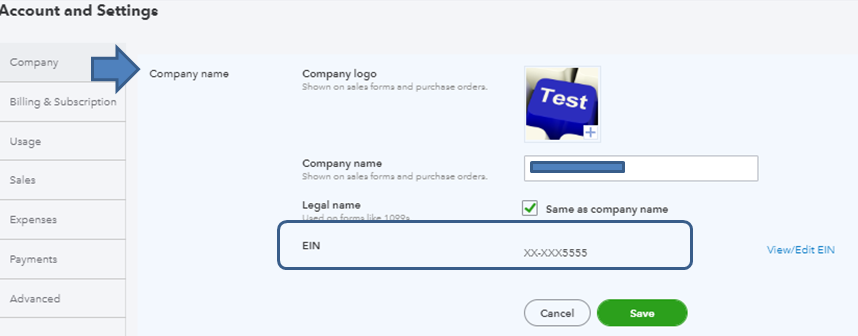

478 Northdale Road Lawrenceville GA 30043. Form used by employers to amend their W-2 and 1099 reconciliations.

How Do I Get My California Employer Account Number

Federal Withholding Not Calculating

As New Withholding Looms Irs Launches Tool To Help Small Businesses Accounting Today

How To Calculate Your Self Employment Tax Gusto

Irs Overhauls Form W 4 For 2020 Employee Withholding

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Irs Overhauls Form W 4 For 2020 Employee Withholding

:max_bytes(150000):strip_icc()/GettyImages-92223836-57a5356b5f9b58974ab7e971.jpg)

Payroll Taxes The Basics For Employers

Irs Assistant Helps Small Businesses Withhold The Right Amount Of Tax Affordable Bookkeeping Payroll

Tax Refunds Increase Compliance And Confidence In System Time

American Finances Updates How To Get Ubi Financial Aid Stimulus Checks In Florida And California

2020 W4 Federal Tax Withholding Assistant

How To Adjust Your Tax Withholdings Using The New W 4 Entertainment Partners

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

2022 Income Tax Withholding Tables Changes Examples

Payroll Human Resources Assistant Resume Examples And Templates That Got Jobs In 2022 Zippia